Individual E-Commerce Business Operators: Tax Declaration and Payment Guidelines (2025)

In recent years, e-commerce (EC) in Vietnam has been booming, with millions of individuals selling on Shopee, Lazada, TikTok Shop, Facebook, Zalo, and their own websites. Individual E-Commerce Business Operators in Vietnam are required to comply with specific regulations on tax declaration and payment when conducting online business activities. This article will help you understand and comply with the regulations properly.

Nội dung

- 1 Who is considered an “individual e-commerce business operator” required to declare tax?

- 2 What types of taxes must individual e-commerce business operators pay?

- 3 Do individual e-commerce business operators need to issue invoices for each order?

- 4 Guidance on tax declaration and payment for individual e-commerce business operators (outside e-commerce platforms)

- 5 Important notes to avoid tax risks

Who is considered an “individual e-commerce business operator” required to declare tax?

An individual e-commerce business operator is any individual engaging in the sale of goods or provision of services through digital platforms such as websites, mobile applications, e-commerce marketplaces (Shopee, Lazada, etc.), or social networks.

According to Decree No. 117/2025/ND-CP (Vietnamese government regulation on e-commerce taxation), such individuals must meet the following criteria:

- Having revenue from online business activities.

- Falling under tax administration as regulated by the tax authorities.

What types of taxes must individual e-commerce business operators pay?

According to Article 4 of Circular No. 40/2021/TT-BTC (Vietnamese Ministry of Finance regulation on tax for individual businesses), individuals operating on e-commerce platforms with annual revenue exceeding VND 100 million must pay Value Added Tax (VAT) and Personal Income Tax (PIT).

Current tax rates for e-commerce platforms

Under Article 10 of Circular No. 40/2021/TT-BTC, the calculation of Value Added Tax (VAT) and Personal Income Tax (PIT) for individuals doing business on e-commerce platforms is determined based on taxable revenue and the applicable tax rate on that revenue. Specifically:

Taxable revenue:

Taxable revenue includes the total amount an individual business operator receives from selling goods or providing services (sales revenue, processing fees, commissions, service provision, incentives for sales targets, promotions, trade discounts, payment discounts, subsidies, surcharges, additional fees, compensation for contract breaches, etc.).

Note: Even if the seller has not yet received payment, the revenue is still considered taxable for VAT and PIT purposes (i.e., taxable revenue is counted regardless of actual payment).

Tax rates:

Based on Article 5 of Decree No. 117/2025/ND-CP, online business activities on e-commerce platforms are generally subject to a combined tax rate of 1.5%, which includes both VAT and PIT. Details are as follows:

- VAT rates under the 2024 VAT Law:

- Goods: 1%

- Services: 5%

- Transportation and services associated with goods: 3%

- PIT rates under the 2007 Personal Income Tax Law:

- For resident individuals:

- Goods: 0.5%

- Services: 2%

- Transportation and services associated with goods: 1.5%

- For non-resident individuals:

- Goods: 1%

- Services: 5%

- Transportation and services associated with goods: 2%

- For resident individuals:

Note:

- If an individual is engaged in multiple business sectors, they must declare and calculate tax based on the applicable rates for each sector.

- If revenue for each sector cannot be determined or is inconsistent with actual operations, the tax authority will impose (assess) taxable revenue for each sector under tax administration laws.

Determining payable tax amounts:

- VAT payable = Taxable revenue for VAT × VAT rate (e.g., 1%)

- PIT payable = Taxable revenue for PIT × PIT rate (e.g., 0.5%)

Regulations on tax withholding and payment by e-commerce platforms

From July 1, 2025, organizations managing e-commerce platforms (both domestic and foreign, including direct owners or authorized representatives) are obligated to withhold and remit taxes on behalf of sellers (household businesses and individual businesses) operating on their platforms.

E-commerce platforms such as Shopee, Lazada, TikTok Shop, Tiki, etc., will be responsible for withholding and remitting VAT and PIT from sellers’ revenues, based on the applicable tax rates mentioned above.

- Tax will be withheld once the transaction is completed and the buyer has made payment.

- Platforms must declare and remit taxes to the tax authority monthly.

- In cases of refunds or returns, the withheld tax can be adjusted in the following period.

Sellers will not need to directly declare and pay VAT or PIT if the platform has already remitted them, but they must still provide identification information such as an ID card/CCCD, Tax Identification Number (TIN), or other required documents.

In addition, sellers are still required to declare and pay other taxes (if applicable), such as special consumption tax, natural resources tax, or environmental protection tax.

Do individual e-commerce business operators need to issue invoices for each order?

According to the General Department of Taxation (Ministry of Finance, Vietnam), individuals doing business on e-commerce platforms and directly selling goods or providing services to consumers are subject to the use of e-invoices generated from cash registers, as stipulated in Clause 8, Article 1 of Decree No. 70/2025/ND-CP.

If an individual business operator authorizes the platform to issue invoices on their behalf, as regulated in Clause 3, Article 1 of Decree No. 70/2025/ND-CP (amending Clause 7, Article 4 of Decree No. 123/2021/ND-CP, effective from June 1, 2025) and Point c, Clause 3, Article 4 of Circular No. 32/2025/TT-BTC (also effective from June 1, 2025), then the e-commerce platform is responsible for issuing invoices on behalf of the authorized individual seller.

Furthermore, from July 1, 2025, Decree No. 117/2025/ND-CP on tax administration for individual e-commerce and household businesses comes into effect. Under this regulation, e-commerce platforms with payment functions are required to withhold, declare, and remit taxes on behalf of sellers. In this case:

- Sellers are still required to issue invoices to customers.

- However, they do not need to declare and pay taxes on the portion of revenue for which the platform has already withheld and remitted taxes.

In practice, according to the Tax Department in charge of e-commerce, individuals whose taxes have already been withheld and declared by platforms are not required to issue invoices for each order. Once tax withholding obligations are fulfilled, invoice issuance requirements can be waived or simplified.

To be certain, individuals and household businesses may contact their assigned tax officers for clarification.

Guidance on tax declaration and payment for individual e-commerce business operators (outside e-commerce platforms)

Step 1: Access the electronic portal: https://canhantmdt.gdt.gov.vn/

Step 2: Log in to your account via the VNeID level-2 electronic identification account.

Step 3: Fill in the declaration information to be issued a tax identification number (TIN) for e-commerce business activities.

The portal will automatically synchronize data from VNeID into the system. The taxpayer only needs to input or adjust 4 basic details as follows:

- Business address

- Business line/sector

- Start date of business activities

- Date and place of issuance of Citizen ID (CCCD).

Note: In cases where an individual already has a TIN, the portal will issue an additional number ending with 888 for e-commerce revenue.

The TIN used for declaring and paying taxes on e-commerce activities will be a 13-digit code ending in 888.

Example: xxxxxxxxx-888

Step 4: Review the information entered in Step 3 and enter the captcha code at the bottom of the page.

Step 5: The portal will send a confirmation code (OTP) to the phone number provided by the taxpayer. The taxpayer enters the OTP code and submits the dossier to await results.

Step 6: After successfully logging into the account, the taxpayer proceeds with the tax declaration => Select “Khai thuế/Tax declaration” for e-commerce business activities.

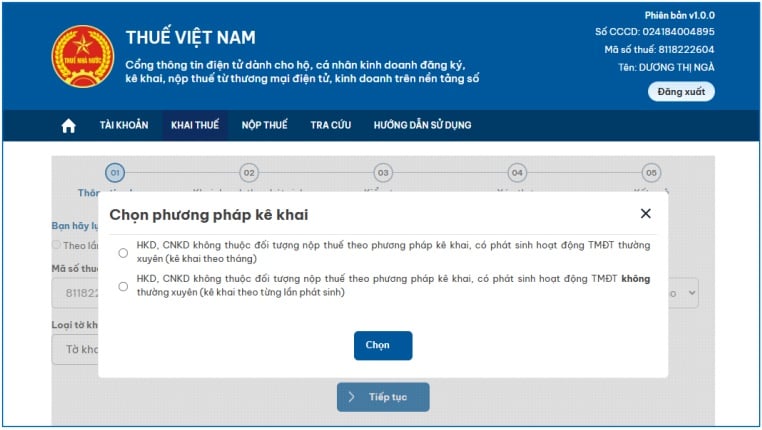

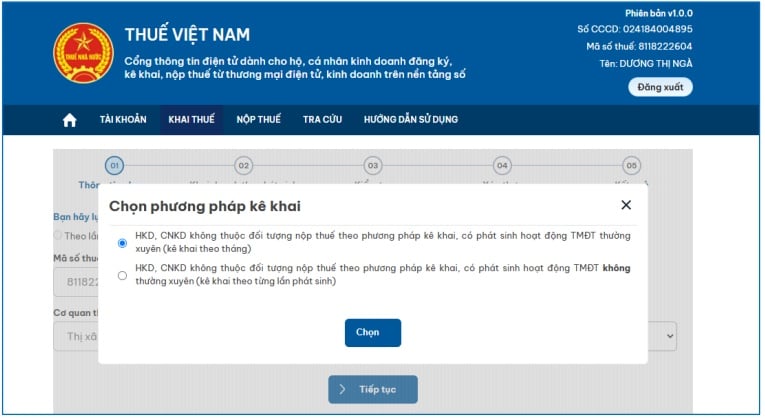

The system will display the screen “Choose declaration method”.

Step 7: Tick one of the two options and click “Select.” The system will automatically assign the tax period as Occurrence/Month depending on the following conditions:

- If ticking “Household or individual business operators with regular e-commerce activities (monthly declaration)”, the system will automatically assign “Month.”

- If ticking “Household or individual business operators with irregular e-commerce activities (declaration per occurrence)”, the system will automatically assign “Occurrence.”

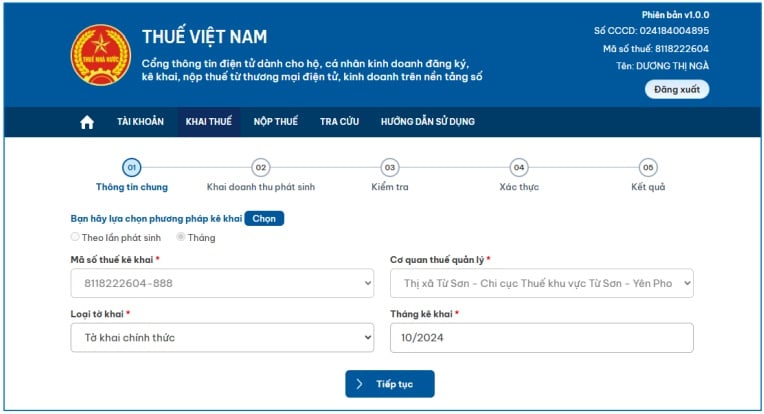

The system will then display the screen to select declaration information.

Default settings include:

- Declared TIN: Automatically displays the 13-digit TIN for e-commerce activities (Code 10-888).

- Managing tax authority: Automatically displays the tax authority managing the e-commerce TIN.

- Declaration type: Default is “Official declaration,” but can be changed to “Official” or “Amended.”

- Declaration month: Default is the current month, editable (for monthly declarations).

- Date of occurrence: Default is the current date, editable (must be ≤ current date, formatted dd/mm/yyyy for per-occurrence declarations).

Note:

- If “Official declaration” is selected, the taxpayer declares revenue arising from the supply of goods/services subject to Special Consumption Tax, Environmental Protection Tax/Fee, or Resource Tax.

- The system will display forms for declaring special consumption tax, environmental protection tax/fee, or resource tax.

- After declaring, click “Continue.” The system will display the review screen. If there are errors, click “Back” to revise. If correct, enter the Captcha code, click “Submit declaration,” enter OTP, then click “Continue.” The system will display a successful declaration message.

- If “Amended declaration” is selected, the system will display the data of the latest accepted declaration for the same tax period. The taxpayer adjusts information on the amended form, clicks “Summarize KHBS,” and the system generates the “Explanation of amended declaration.”

- The taxpayer reviews information on: Tax declaration form for household/individual businesses, Explanation of amended declaration, and Amended declaration form.

- If information is correct, enter the Captcha code, click “Submit declaration,” enter OTP, then click “Continue.” The system will display a successful declaration message.

- After revenue information is declared, the system will automatically calculate the payable tax amount.

Step 8: Pay taxes using one of two methods:

- Select “Pay taxes now” after completing the declaration.

- Or go to the main system interface => Select the “Tax Payment” tab => Choose “Create payment slip.”

Step 9: Choose the linked bank account/card to make the tax payment.

- If no account/card is linked, click “Link account now.”

- If an account or card was previously linked, select the desired account/card, then click “Continue.”

Step 10: Select the payable items:

- The system displays a list of state budget payable items, the desired payment amount, and the total payable amount. The taxpayer selects the payable item and clicks “Pay taxes.”

- The taxpayer clicks “Query” to check information about:

- Taxes, late payment interest, penalties;

- Other state budget receivables, excluding penalties and late payment interest;

- Taxes pending processing.

The taxpayer ticks the payable items, and the system displays them on the payment slip screen. Click “Continue,” select “Generate payment slip,” then click “Pay taxes” to proceed with the payment process.

Step 11: The taxpayer enters the OTP sent by the bank via SMS or mobile banking app, then clicks “Authenticate.”

- If the OTP is valid, the system will display “Success.”

- If the OTP is invalid, the system will display “Failure.” The taxpayer then clicks “Home,” then selects “Continue tax payment,” and the system will display the next payment slip.

Important notes to avoid tax risks

- Transparent revenue: Keep reports from e-commerce platforms or sales books.

- Issuing invoices upon request: Especially when selling to business customers.

- Document retention: Keep input invoices and supporting documents to substantiate deductible expenses.

- Avoid tax evasion: If discovered, violators may face administrative fines or even criminal liability.

E-commerce business offers many opportunities, but it also comes with the obligation to declare and pay taxes. Online sellers need to understand the regulations, determine their revenue, declare and pay taxes on time to ensure their business remains legal, safe, and sustainable.

However, for those who are new to business or unfamiliar with tax procedures, filing declarations can be confusing. In such cases, you may consider using the online accounting and tax services at topa.vn. Our professional team will support you, allowing you to focus on sales and business growth with peace of mind.

>> Read more: Top 5 dịch vụ kế toán thuế uy tín tại TP.Hồ Chí Minh