Software Production Report Template and Submission Guidelines 2025

Why Businesses Need to Submit a Software Production Report

The Software Production Report is not merely an administrative procedure — it serves as an essential basis for enterprises to qualify for Corporate Income Tax (CIT) incentives.

According to current regulations, businesses engaged in software production are required to submit an “Annual Report on Software Production Activities” to the Ministry of Information and Communications no later than March 15 of the following year.

Although existing legal documents provide limited details on the report’s specific contents, in practice, recent tax inspections and audits have treated this report as a key reference in assessing whether an enterprise complies with the software production process. This directly affects the company’s eligibility for CIT incentives.

Therefore, we strongly recommend that software-producing enterprises submit their annual reports fully and on time — both to ensure legal compliance and to minimize tax-related risks when reporting to the Ministry of Information and Communications.

Legal Basis

Decree No. 71/2007/NĐ-CP (Article 15, Clause c):

“…Annually, no later than March 15, information technology enterprises must submit a report on their activities in the information technology industry for the preceding year to the local Department of Posts and Telecommunications. The Ministry of Posts and Telecommunications shall provide detailed regulations on the report’s contents.”

Circular No. 13/2020/TT-BTTTT (Article 5, Clause 2, Point b):

“Organizations and enterprises engaged in software production are responsible for submitting and updating information on software products and production stages that meet the prescribed process and tax deduction criteria to the Ministry of Information and Communications (Information Technology Department) for consolidation.”

Reporting Frequency

- Annually: Enterprises must submit the report once per year, summarizing their software production activities from the previous year.

- Upon changes: If there are new product projects, revenue fluctuations, or adjustments in corporate income tax incentive levels, an additional report must be submitted.

Timely updates help enterprises avoid tax risks and demonstrate compliance with lawful software production activities.

Detailed Submission Guidelines

Step 1: Visit the official website: https://makeinvietnam.mic.gov.vn/

Step 2: Log in using your enterprise account.

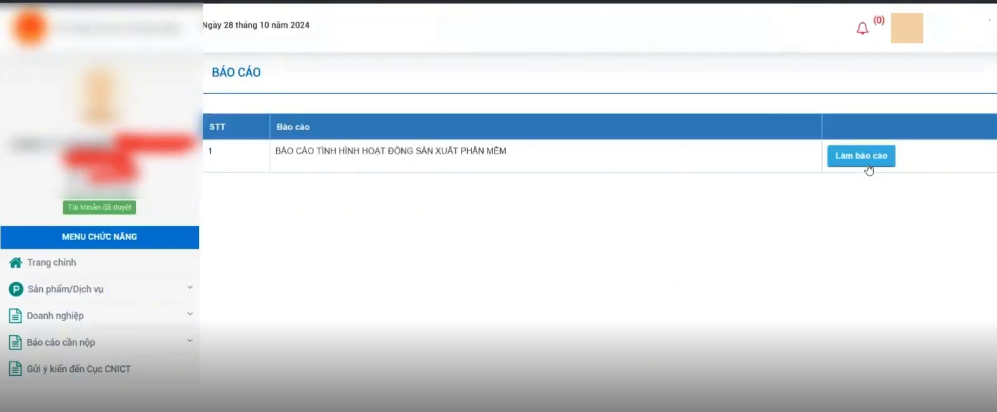

Step 3: Click “Reports to be submitted” on the left sidebar, then select “Submit Report.”

Step 5: Click “Save Report.”

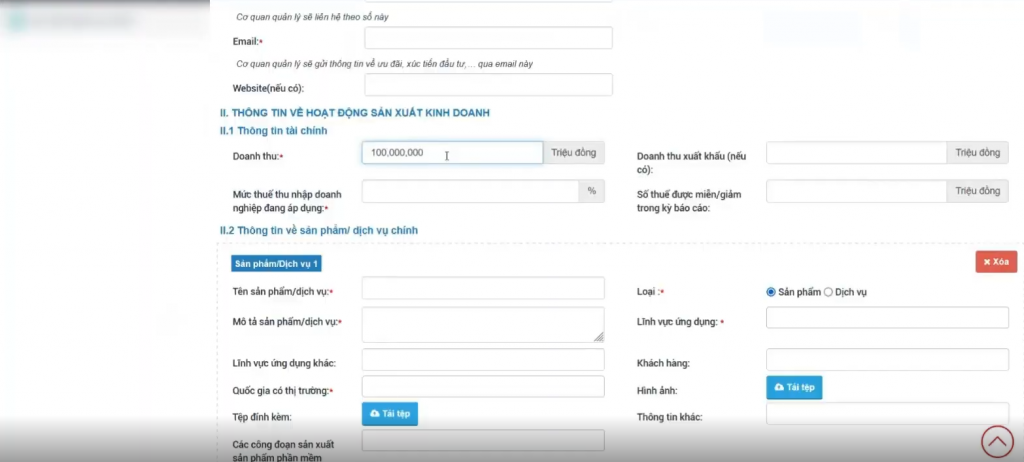

Step 6: Fill in all required information fields completely.

Note: For file uploads, supporting documents should bear the company’s official signature and seal. Uploading files in PDF format is recommended for convenience.

Step 7: Click “Submit Report” once all information has been completed. If not yet finalized, select “Save Report.”

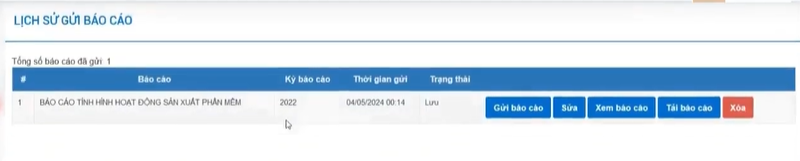

Step 8: Monitor the status of your submitted report.

Note: The report status can be tracked directly on the website. There will be no confirmation email or notification sent to the enterprise.

View the Report Template and Video Submission Guide

Topa has prepared a detailed step-by-step instructional video on how to complete and submit the online report, making it easier for businesses to follow and practice the process efficiently.

Software Production Report Instruction Video — From Document Preparation to Online Submission

The instructional video provides a comprehensive, step-by-step guide to preparing and submitting the software production report online, helping businesses avoid errors and stay compliant with 2025 regulations.

Common Issues with Tax Authorities for Software Manufacturing Enterprises

Tax Incentives for Software Enterprises: Key Questions Answered