Previous Years Had Low Fixed Tax Rates; How to File Supplementary Tax Declarations Now?

In practice, many business households have been subject to the fixed tax method with low fixed tax amounts in previous years. However, upon reviewing business operations or at the request of tax authorities, business households must file supplementary declarations for past years to avoid legal risks.

Nội dung

- 1 I. When Must Business Households File Supplementary Tax Declarations?

- 2 II. Which Laws Apply to Supplementary Declarations for Past Years?

- 3 III. Methods for Filing Supplementary Tax Declarations for Business Households

- 4 IV. How Are Business Households Penalized for Late Tax Registration Beyond the Prescribed Deadline?

- 5 V. How Are Penalties Imposed for Late Submission of VAT Declarations?

- 6 VI. Advice for Business Households

I. When Must Business Households File Supplementary Tax Declarations?

Supplementary declarations are required if revenue exceeds 1.5 times the fixed amount. However, upon reviewing business operations or at the request of tax authorities, business households must file supplementary declarations for past years to avoid legal risks.

II. Which Laws Apply to Supplementary Declarations for Past Years?

👉 Key Principle: Supplementary declarations for a given year must follow the tax laws of that year.

This mean: Even if current tax policies have changed, when filing supplementary declarations for previous years, business households must still:

- Apply the old legal regulations.

- Be taxed on the revenue generated in the year in question.

📌Therefore, having a “low fixed tax in the past” does not mean exemption from taxes when filing supplementary declarations.

III. Methods for Filing Supplementary Tax Declarations for Business Households

To file supplementary tax declarations for past years, you need to prepare documentation proving actual revenue and submit it according to the proper procedures. Here are the detailed steps:

1. Prepare Evidence of Actual Revenue

The best approach is to collect bank statements or proof of accurate revenue levels. These documents will help tax authorities verify quickly and avoid disputes. Essential documents include:

- Bank transaction statements (from the bank or online banking apps).

- Sales invoices, business contracts, revenue ledgers.

- Financial reports if you are a business entity.

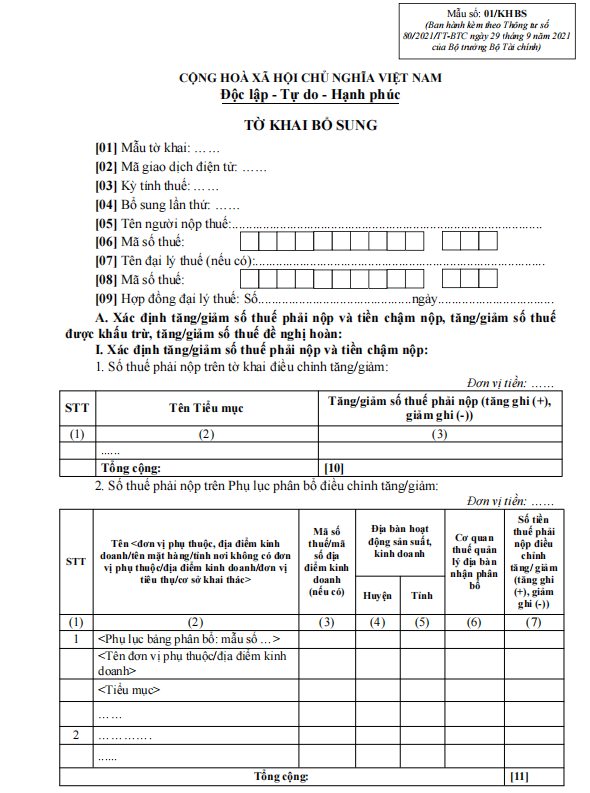

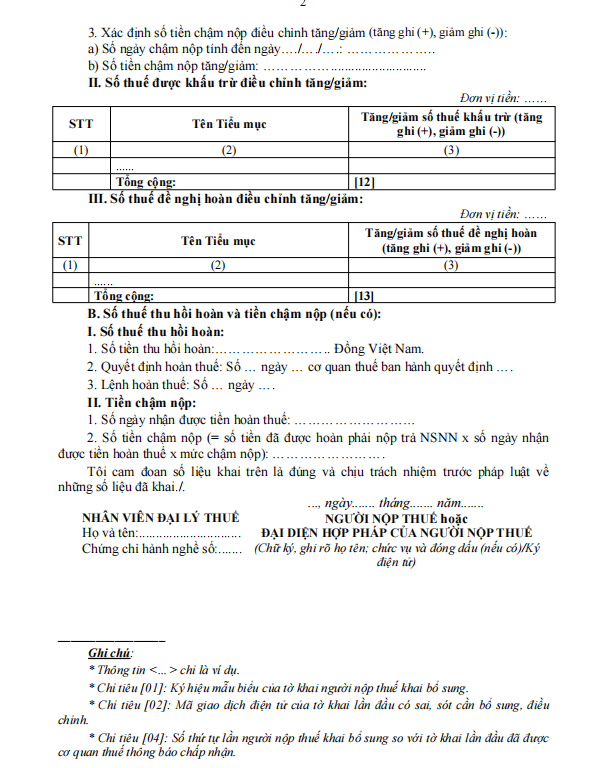

→ According to Clause 4, Article 47 of the 2019 Tax Administration Law, the supplementary declaration dossier includes:

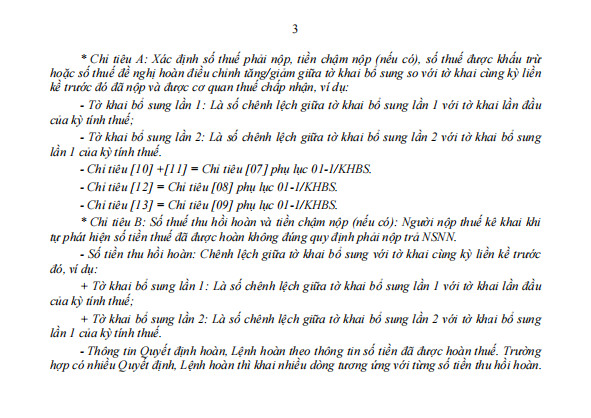

- Supplementary declaration form using Form 01/KHBS issued with Circular 80/2021/TT-BTC.

- Explanation for supplementary declaration using Form 01-1/KHBS in Appendix II issued with Circular 80/2021/TT-BTC, along with related documents.

2. Submit Directly at the Tax Authority

The safest and most efficient way is to bring the dossier directly to the managing tax authority where the business household or individual operates. Advantages:

- Immediate feedback to avoid errors.

- Suitable for business households unfamiliar with electronic systems.

3. File Supplementary Tax Declarations Online via Electronic System

Guide to declaring taxes for business households via the eTax mobile app:

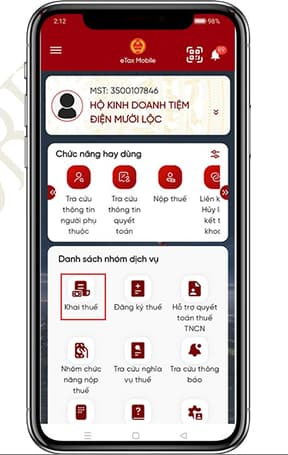

Step 1: The taxpayer (TP) selects the “Khai thuế” service group -> chooses the “Tra cứu hồ sơ khai thuế” function.

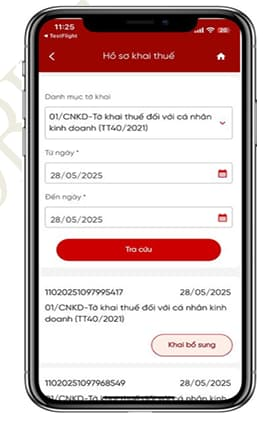

Bước 2: The search screen appears. The taxpayer enters search information:

– Declaration category: Select 01/CNKD- Tờ khai thuế đối với cá nhân kinh doanh (Thông tư 40/2021/TT-BTC)

– Từ ngày – đến ngày (From date/to date): Enter the declaration submission dates. The taxpayer clicks “Tra cứu”. The search results screen appears.

Bước 3: On the search results screen, click “Khai bổ sung”, which displays the declaration information screen for the selected supplementary declaration.

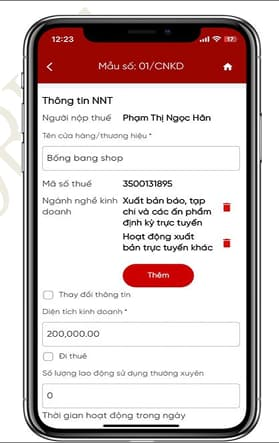

Bước 4: The taxpayer edits and changes the information on the declaration and click “Tổng hợp KHBS”

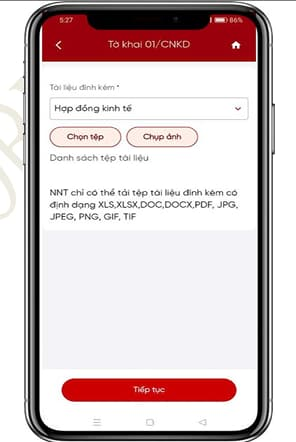

Bước 5: The attachment screen appears; the taxpayer attaches files in formats: Doc, docx, Excel, PDF, images. Click “Tiếp tục”.

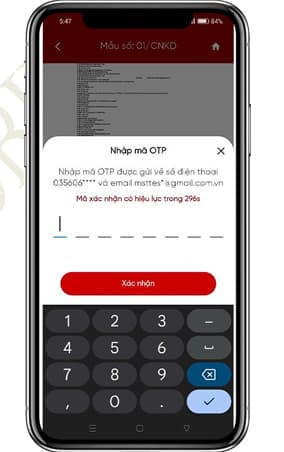

Bước 6: The OTP entry screen appears; the taxpayer enters the OTP sent to their email. Click “Xác nhận”.

IV. How Are Business Households Penalized for Late Tax Registration Beyond the Prescribed Deadline?

Pursuant to Article 10 of Decree 125/2020/ND-CP on penalties for violations regarding deadlines for notifying changes in tax registration information as follows:

1. Warning penalty for acts of tax registration; notifying temporary business suspension; notifying resumption of business before the announced deadline exceeding the prescribed time by 1 to 10 days, with mitigating circumstances.

2. Fine from 1,000,000 VND to 2,000,000 VND for one of the following acts:

a) Tax registration; notifying resumption of business before the announced deadline exceeding the prescribed time by 1 to 30 days, except as provided in Clause 1 of this Article;

b) Notifying temporary business suspension exceeding the prescribed deadline, except as provided in Clause 1 of this Article;

c) Failing to notify temporary business suspension.

3. Fine from 3,000,000 VND to 6,000,000 VND for acts of tax registration; notifying resumption of business before the announced deadline exceeding the prescribed time by 31 to 90 days.

4. Fine from 6,000,000 VND to 10,000,000 VND for one of the following acts:

a) Tax registration; notifying resumption of business before the announced deadline exceeding the prescribed time by 91 days or more;

b) Failing to notify resumption of business before the announced deadline but no tax payable arises.

V. How Are Penalties Imposed for Late Submission of VAT Declarations?

Pursuant to Article 13 of Decree 125/2020/ND-CP on penalties for late submission of tax declarations in 2025 for organizations, and Clause 5, Article 5 of Decree 125/2020/ND-CP specifies that penalties for individuals and business households are half the amount for organizations, as follows:

| Late submission period | Penalty for Business households | Penalty for Organizations |

| 01 to 05 days with mitigating circumstances | Warning | Warning |

| 01 to 30 days (excluding warning cases) | 1.000.000 – 2.500.000 VNĐ | 2.000.000 – 5.000.000 VNĐ |

| 31 to 60 days | 2.500.000 – 4.000.000 VNĐ | 5.000.000 – 8.000.000 VNĐ |

| – 61 to 90 days – 91 days or more but no tax payable arises – Not submitting dossiers but no tax payable arises – Not submitting appendices as required for tax management for enterprises with related-party transactions attached to corporate income tax finalization dossiers | 4.000.000 – 7.500.000 VNĐ | 8.000.000 – 15.000.000 VNĐ |

| Over 90 days, with tax arising, full tax and late payment interest paid before tax authority announces tax inspection or audit decision or before the tax authority prepares a record on late declaration as per Clause 11, Article 143 of the Tax Administration Law | 7.500.000 – 12.500.000 VNĐ(Maximum equal to arising tax but not less than average organizational bracket / 2) | 15.000.000 – 25.000.000 VNĐ(If penalty > arising tax, maximum equal to arising tax, but not less than average bracket) |

👉 Note: If tax payable arises and is paid late, add late payment interest at 0.03% per day on the late tax amount. The formula for calculating the specific penalty is:

Penalty amount = Late tax amount x 0.03% x Number of late days

→ Wherein, the number of late payment days is determined as follows:

- The number of late payment days includes holidays and days off as prescribed by law.

- The time is calculated from the day immediately following the tax payment deadline, extension period, or deadline on the notice/decision on tax violation handling until full payment into the state budget (including late payment penalties).

VI. Advice for Business Households

1. Prepare for Policy Changes in 2026

From 2026, business households must declare taxes based on actual revenue instead of the fixed method. This is a major change directly affecting tax declaration methods for millions of business households nationwide.

👉 If your actual revenue in previous years differs significantly from the fixed amount, it’s best to proactively file supplementary declarations now. This helps avoid conflicts with old tax records when applying the new policy and demonstrates good faith in complying with the law to tax authorities.

2. Special Cases Requiring Early Declarations

Individuals and business households receiving income from abroad need to pay special attention and proactively declare taxes early. Common cases include:

- Income from Google AdSense, YouTube: When your YouTube channel generates advertising revenue.

- Income from Apple App Store: Developing and selling apps on international platforms.

- Selling on cross-border e-commerce platforms: Amazon, eBay, international Shopee.

- Providing freelance services to foreign clients: Upwork, Fiverr, Freelancer.

📌 Why declare early? These international transactions are often closely monitored by tax authorities through automatic information exchange systems with other countries.

⇒ Proactively declaring helps you:

- Avoid heavy penalties if tax authorities discover through international systems.

- Enjoy legal tax incentives if applicable.

- Prove legitimate income sources when needed.

3. Prepare Full Legal Documentation

Documentation is key to the accuracy of supplementary declarations. Systematize all bank statements, sales invoices, contracts, and ledgers by year. Organize documents chronologically and store both hard and soft copies for easy reference.

4. Consider Professional Tax Consulting Services

If the dossier is complex or involves multiple years with large revenues, hiring tax consulting services is worth considering. Tax experts ensure accurate declarations and optimize legal tax obligations. Consulting fees are often much lower than penalties for incorrect declarations.

5. Retain Proof of Completed Obligations

After completing supplementary declarations, carefully store receipts, tax payment proofs, and accepted declarations. As per regulations, retain tax records for at least 10 years in case of future inspections or audits.

VI. Conclusion

Filing supplementary tax declarations may be complex but is a mandatory legal responsibility. Especially in the context of transitioning to actual revenue-based tax declarations from 2026, proactively filing early will help business households avoid many future legal and financial risks.