Update on Tax Authority Addresses in Thai Nguyen After Administrative Restructuring

Businesses in Thai Nguyen — have you updated the address of your tax authority for 2025 yet?

Amid adjustments to administrative boundaries and the restructuring of the state management system, changes to the headquarters and jurisdiction of tax authorities have become an inevitable trend. For businesses, this is no longer merely an administrative formality, but a factor that directly affects legal operations, tax compliance, and internal governance structures.

Many businesses only become aware of the issue when problems arise—such as incomplete documentation, procedural disruptions, or administrative obstacles. In reality, ensuring the correct identification of the supervising tax authority should be regarded as an integral part of legal risk management, rather than a reactive response to emerging issues.

This article provides the latest updates on the addresses of tax authorities in Thai Nguyen in 2025, helping businesses to:

Proactively identify risks – standardize information – and ensure proper tax system operations from the outset.

Nội dung

- 1 1. Why Do Businesses Need to Update the Address of Their Tax Authority in Thai Nguyen?

- 2 2. Changes in Tax Administration Jurisdiction in Thai Nguyen in 2025: What Should Businesses Understand?

- 3 3. Guidance on Checking the Tax Authority Supervising a Business

- 3.1 Step 1: Access the following link: https://tracuunnt.gdt.gov.vn/tcnnt/mstdn.jsp

- 3.2 Step 2: Select the section “Taxpayer Information” to check the tax authority supervising the business.

- 3.3 Step 3: Enter one of the four suggested search criteria to retrieve information (most commonly, the tax identification number).

- 3.4 Step 4: After entering the required information, click Search. The system will display an overview of the taxpayer’s information.

- 3.5 Click on the taxpayer’s name to view detailed information.

- 4 4. What Should Businesses Do When the Tax Authority Address Changes?

- 5 5. Tax Information Update Support Services in Thai Nguyen

1. Why Do Businesses Need to Update the Address of Their Tax Authority in Thai Nguyen?

Updating the address of the tax authority is not simply an administrative adjustment; it is a matter of legal governance, risk management, and operational management within a business.

From a legal perspective, the entire system of corporate documentation—tax returns, electronic invoices, tax refund dossiers, financial statements, accounting records, and business registration amendments—is directly linked to the supervising tax authority. When a business applies the incorrect tax authority, its documents may lose legal validity, leading to the rejection of filings, procedural delays, and increased compliance risks.

From an operational standpoint, incorrect tax authority information may result in delays in document processing, postponed tax refunds, administrative bottlenecks, and disruptions to financial and accounting workflows. These disruptions not only increase operating costs but also directly affect cash flow and financial planning.

From a legal compliance perspective, the Law on Tax Administration clearly stipulates that businesses are responsible for accurately updating tax-related information in accordance with the relevant administrative jurisdiction. Failure to update, or incorrect updates, may give rise to administrative penalties related to tax compliance.

Therefore, updating the tax authority’s address should not be viewed merely as a technical procedure, but rather as a legal risk management action—one that helps businesses safeguard stability, security, and continuity across their entire tax compliance system.

2. Changes in Tax Administration Jurisdiction in Thai Nguyen in 2025: What Should Businesses Understand?

In 2025, Thai Nguyen has recorded significant adjustments in the organization of state administration, including the reconfiguration of administrative units, the restructuring of district-level tax offices, and the reallocation of enterprise management jurisdictions in line with regional development planning.

As a result:

- Some businesses have been reassigned to different directly supervising tax authorities

- Certain tax sub-departments have changed their headquarters, addresses, or management scope

This means that determining the tax authority responsible for a business can no longer rely on former administrative boundaries or previous operational practices. Businesses must verify information based on the most up-to-date management data, as published by the tax system and official information sources, in order to ensure legal accuracy throughout all tax-related activities and corporate documentation.

| No. | Local Tax Office | Management Jurisdiction | Head Office Address |

| 1 | Local Tax Office No. 1 – Thai Nguyen Province | Phan Dinh Phung Ward, Gia Sang Ward, Tich Luong Ward, Linh Son Ward, Quyet Thang Ward, Quan Trieu Ward, Tan Cuong Commune, Bach Quang Ward | No. 132 Hoang Van Thu Street, Phan Dinh Phung Ward, Thai Nguyen Province |

| 2 | Local Tax Office No. 2 – Thai Nguyen Province | Pho Yen Ward, Van Xuan Ward, Trung Thanh Ward, Phuc Thuan Ward, Thanh Cong Commune, Phu Binh Commune, Diem Thuy Commune, Tan Thanh Commune, Kha Son Commune, Tan Khanh Commune, Song Cong Ward, Ba Xuyen Ward | Dinh Residential Area, Van Xuan Ward, Thai Nguyen Province |

| 3 | Local Tax Office No. 3 – Thai Nguyen Province | Dai Tu Commune, Duc Luong Commune, Phu Thinh Commune, La Bang Commune, Phu Lac Commune, An Khanh Commune, Quan Chu Commune, Van Phu Commune, Phu Xuyen Commune, Dai Phuc Commune | Dinh Hamlet, Dai Phuc Commune, Thai Nguyen Province |

| 4 | Local Tax Office No. 4 – Thai Nguyen Province | Phu Luong Commune, Vo Tranh Commune, Yen Trach Commune, Hop Thanh Commune, Dinh Hoa Commune, Binh Yen Commune, Trung Hoi Commune, Phuong Tien Commune, Phu Dinh Commune, Binh Thanh Commune, Kim Phuong Commune, Lam Vy Commune | An Thai Sub-area, Du Town, Phu Luong Commune, Thai Nguyen Province |

| 5 | Local Tax Office No. 5 – Thai Nguyen Province | Dong Hy Commune, Quang Son Commune, Trai Cau Commune, Nam Hoa Commune, Van Han Commune, Van Lang Commune, Vo Nhai Commune, Dan Tien Commune, Nghinh Tuong Commune, Than Sa Commune, La Hien Commune, Trang Xa Commune, Sang Moc Commune | Luong Residential Area, Dong Hy Commune, Thai Nguyen Province |

| 6 | Local Tax Office No. 6 – Thai Nguyen Province | Duc Xuan Ward, Bac Kan Ward, Phu Thong Commune, Cam Giang Commune, Vinh Thong Commune, Bach Thong Commune, Phong Quang Commune, Nam Cuong Commune, Quang Bach Commune, Cho Don Commune, Yen Thinh Commune, Yen Phong Commune, Nghia Ta Commune | Group 1A, Bac Kan Ward, Thai Nguyen Province |

| 7 | Local Tax Office No. 7 – Thai Nguyen Province | Ba Be Commune, Cho Ra Commune, Phuc Loc Commune, Thuong Minh Commune, Dong Phuc Commune, Thuong Quan Commune, Bang Van Commune, Ngan Son Commune, Na Phac Commune, Hiep Luc Commune, Bang Thanh Commune, Nghien Loan Commune, Cao Minh Commune | Sub-area 2, Cho Ra Commune, Thai Nguyen Province |

| 8 | Local Tax Office No. 8 – Thai Nguyen Province | Tan Ky Commune, Thanh Mai Commune, Thanh Thinh Commune, Cho Moi Commune, Yen Binh Commune, Van Lang Commune, Cuong Loi Commune, Na Ri Commune, Tran Phu Commune, Con Minh Commune, Xuan Duong Commune | Hamlet 10, Cho Moi Commune, Thai Nguyen Province |

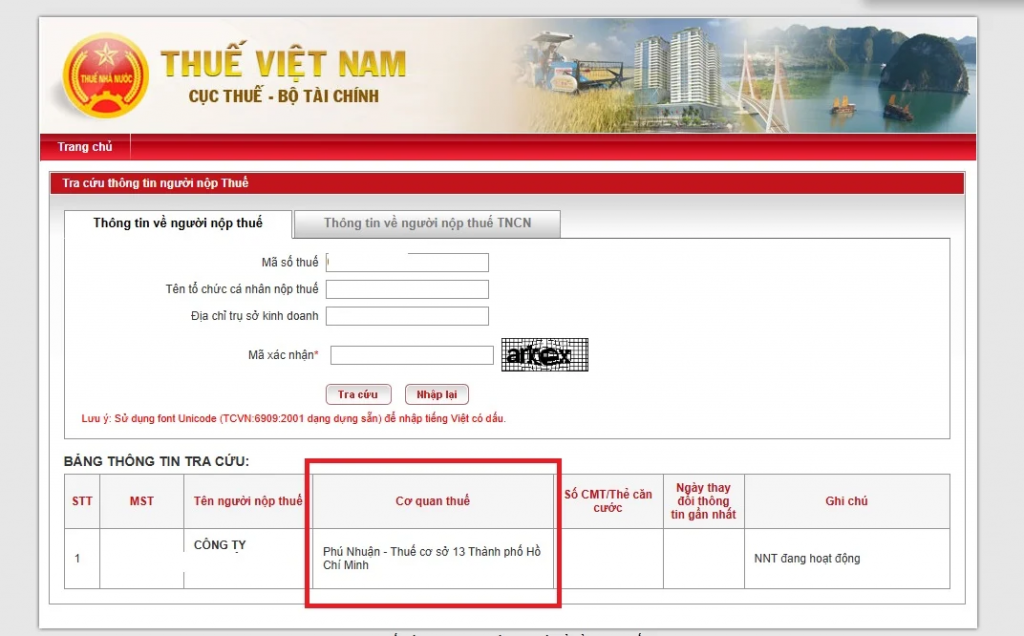

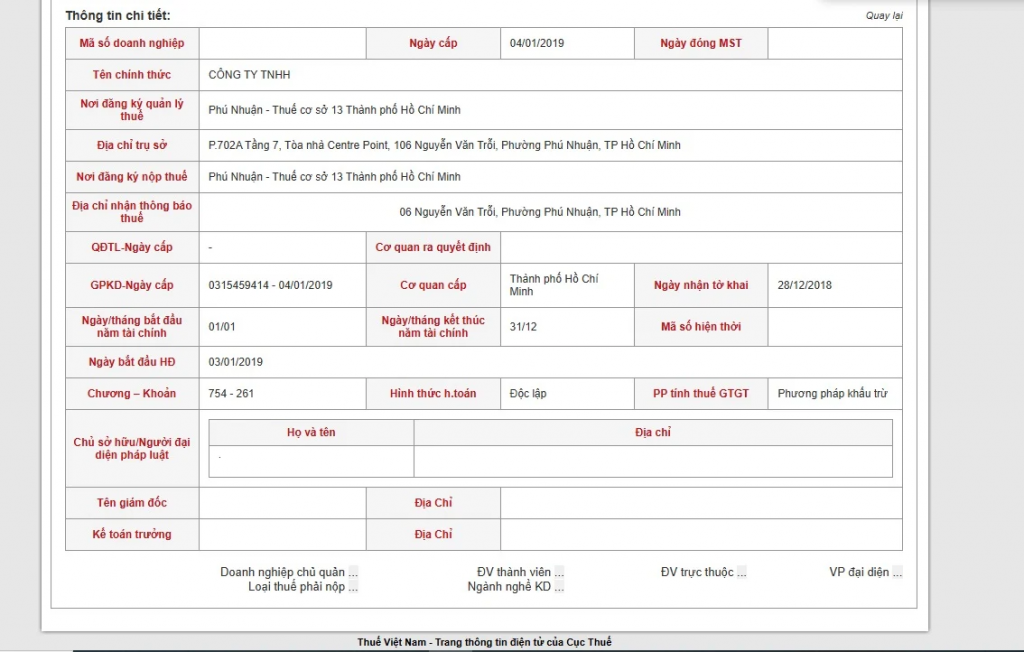

3. Guidance on Checking the Tax Authority Supervising a Business

Step 1: Access the following link: https://tracuunnt.gdt.gov.vn/tcnnt/mstdn.jsp

Step 3: Enter one of the four suggested search criteria to retrieve information (most commonly, the tax identification number).

Step 4: After entering the required information, click Search. The system will display an overview of the taxpayer’s information.

Click on the taxpayer’s name to view detailed information.

4. What Should Businesses Do When the Tax Authority Address Changes?

🔹 Synchronize Internal Systems

- Update information in accounting software

- Synchronize data within the electronic invoicing system

- Adjust information in the ERP system (if applicable)

- Standardize internal administrative forms

🔹 Adjust Legal and Tax Documentation

- Update tax filings according to the newly assigned tax authority

- Adjust financial statements and tax reports

- Synchronize accounting records

- Update tax dossiers based on the latest management data

🔹 Synchronize External Information

- Update partner and client records

- Adjust information stated in contracts

- Synchronize data in related financial transactions

🔹 Review Business Registration Information

In cases where legal information changes arise:

→ Carry out the necessary procedures with the Business Registration Office in accordance with current legal regulations.

5. Tax Information Update Support Services in Thai Nguyen

In practice, not every business has sufficient resources or expertise to continuously monitor changes in tax administration jurisdictions, update accounting and tax systems, synchronize data, and handle related administrative procedures. Changes that may seem minor from a management perspective can sometimes create a chain reaction affecting legal documentation, operational processes, and overall compliance.

In this context, 1ketoan does not approach businesses merely as a service provider, but rather as a long-term accounting partner, working alongside enterprises to build a stable, compliant, and sustainable tax–accounting system from the ground up.

1ketoan provides comprehensive and in-depth support to businesses in Thai Nguyen, including:

- Advising on the accurate identification of the directly supervising tax authority based on the latest management data

- Synchronizing and updating information across:

- Accounting software

- Electronic invoicing systems

- Tax dossiers and related legal documentation

- Accounting software

- Guiding businesses through arising administrative procedures in compliance with applicable regulations

- Connecting and synchronizing data across tax, accounting, and legal systems to ensure overall consistency

- Closely monitoring notifications and adjustments from tax authorities to ensure timely updates for businesses

The goal of 1ketoan is not merely to help businesses “complete procedures correctly,” but to support them in building a safe, transparent, and stable tax compliance system—thereby minimizing the risk of errors, reducing exposure to penalties, and establishing a solid legal foundation for long-term growth.

Summary of New Laws on Insurance and Labor Applicable in 2026

Personal Income Tax Law Amendment 2025: What Should Household Businesses Pay Attention To?