To – Do List For New Company In Vietnam (After Establishment)

After establishment, the new company will have a lot of things to do. So with the FDI company, TOPA.VN believes that you don’t know exactly what the Administrative job needs to do before you start your business action. By this topic, we only want to share some information with the new Company about Tax – Invoice and Administrative procedure. This is a must-do job for your company, so please don’t ignore this.

Nội dung

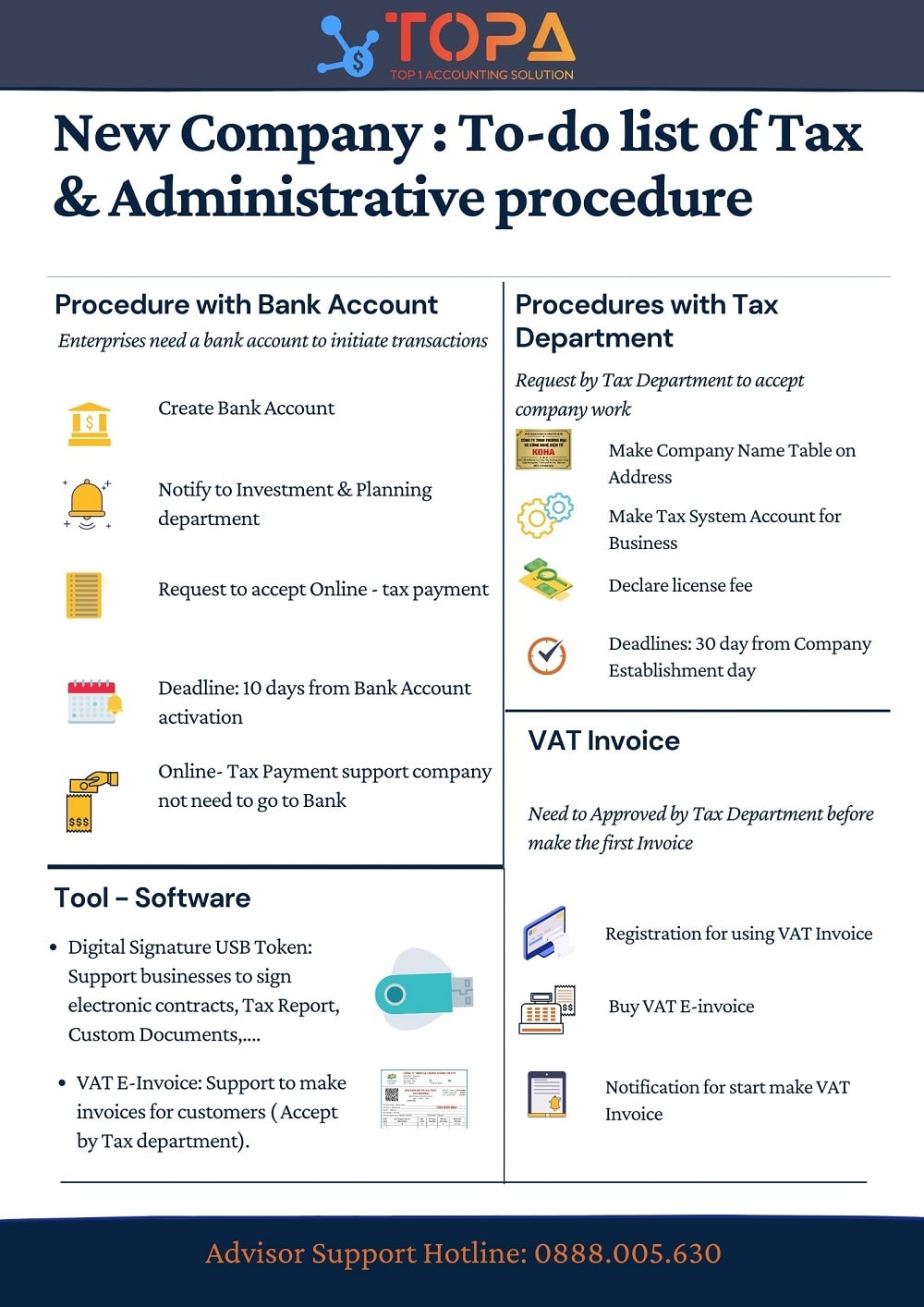

List to-do job for new company after establishment

Buy Tool – Software

Vietnam is one of the most improved countries about the electronics public Service. To use that service, you need to Buy Tool- Software to support

- Digital Signature USB Token: Support businesses to sign electronic contracts, Tax Report, Custom Documents,….

- Electronics VAT Invoice: Support businesses to make invoices for customers ( Accept by Tax department). It’s not same with others country, where the VAT Invoice form make by Company

Request by Tax Department

The Tax Department in Vietnam is the administrative agency all companies don’t want to meet. So you need to completed all this process to make sure that they don’t hamper to your business:

- Make Company Name Table on Address

- Make Tax System Account for Business

- Declare license fee (New businesses are exempt from license fees on their first year)

- Registration for using VAT Invoice

- Notification for start make VAT Invoice

Bank Processes

For your payment and transaction, please use the Bank account. To accept by Public Agencies, please follow that work :

- Create Bank Account

- Notify to Investment planning department

- Request to accept Online – tax payment

Inforgraphics

Please check these procedures carefully and make sure your business is ready to work. If not, please contact us – TOPA.VN. We will accompany you with your business for a long time with Tax – Accounting work.